It's finally yours. Your very own home. You can paint the walls whatever you like. Heck, even knock out a wall! There's no landlord to fight you.

But if you're serious about developing good homeowner habits (so your home makes you richer, not poorer), you'll use this worksheet the minute you close on your home — if not before. Easier to do now than suffer some head-slapping regrets later.

If that doesn't do it for you, here's a *cheater* version done in the form of 22 tips. You only need to scroll:

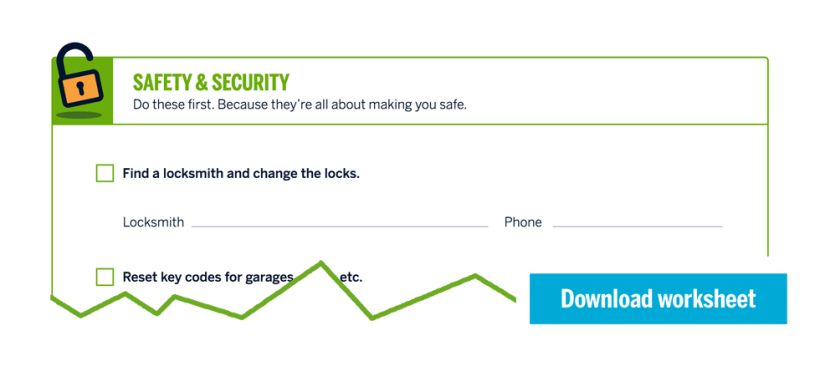

Security & Safety

These are the very first things you should do after buying a house (for obvious reasons):

1. Change locks. Spares could be floating around anywhere.

2. Hide an extra key in a lockbox. Thieves look under flower pots.

3. Reset the key codes for garage doors, gates, etc. The former owners might've trusted half the neighborhood.

4. Test fire and carbon monoxide detectors. Who knows when the last time was. Definitely install them if there are none.

5. Check the temperature on your water heater, especially if you have young ones, so it won't accidentally scald. Manufacturers tend to set them high (but the best temperature setting for hot water is 120 degrees).

6. Make sure motion lights and other security lights have working bulbs.

7. Put a fire extinguisher in the kitchen and each additional floor.

Maintenance Planning

Start your master maintenance plan (and good home-keeping habits) by setting reminders in your calendar to do these basic maintenance tasks:

8. Clean out the dryer hose and vent yearly. Clogged ones burn down houses. And you don't know the last time the previous homeowner did it.

9. Change your HVAC filters at least once a season. You'll save on heating and cooling — and your unit will last longer. (While you're at it, go ahead and stock up on them, too.)

10. Schedule HVAC maintenance for spring and fall.

11. Clean your fridge coils at least once a year. It'll run better and last longer. (Don't see any coils? Lucky you! Newer fridges often have coils insulated, so there's no need for annual cleaning.)

12. Drain your water heater once a year.

13. Clean your gutters at least twice a year.

14. And if all items on your inspection report were not addressed, make a plan to fix them — before they become bigger and more expensive repairs.

Emergency Preparedness

You really really don't want to be figuring any of this out in a real emergency. Do it now. You'll sleep better and be less likely to ruin your home.

15. Locate the main water shut-off valve. Because busted pipes happen to almost every homeowner at least once. And water damage is value-busting and pricey to fix.

16. Find the circuit box, and label all circuit breakers.

17. Find the gas shut-off valve, too, if you have gas.

18. Test the sump pump if you have one. Especially before the rainy season starts.

19. List emergency contacts. You already know 911. These are the other numbers you often need in an emergency. You should have them posted where they're easy to see. In fact, here's a worksheet you can fill out and post.

- Your utility companies

- Your insurance agent

- Plumber

- Electrician

20. Assemble an emergency supply kit. Some key items are:

- Flashlights and batteries

- Non-perishable food and water

- Blankets and warm clothing

- A radio, TV, or cell phone with backup batteries

Home & Mortgage Documents

These are in case there's a dispute with your mortgage lender or a neighbor over property lines, or if you're a bit forgetful about due dates.

21. Store copies (the originals should be in a fireproof safe or safety deposit box) of important home documents so they're readily available. Go paper, cloud, or better, yet, both.

- Lender contact information

- Property survey

- Inspection report

- Final closing documents

- Insurance documents

22. Set mortgage and other bills to auto-pay so you're never late.

Related: 8 Costly Missteps New Homeowners Make in Their First Year