It’s time for your annual checkup. The good news is that for this one, you won’t have to don one of those revealing hospital gowns -- and you may walk away with a healthier pocketbook.

We’re talking about a homeowners insurance checkup, a task you should complete once a year, ideally around renewal time. This will ensure your policy still provides the right level of coverage for your family and your premium isn’t costing you more than it should.

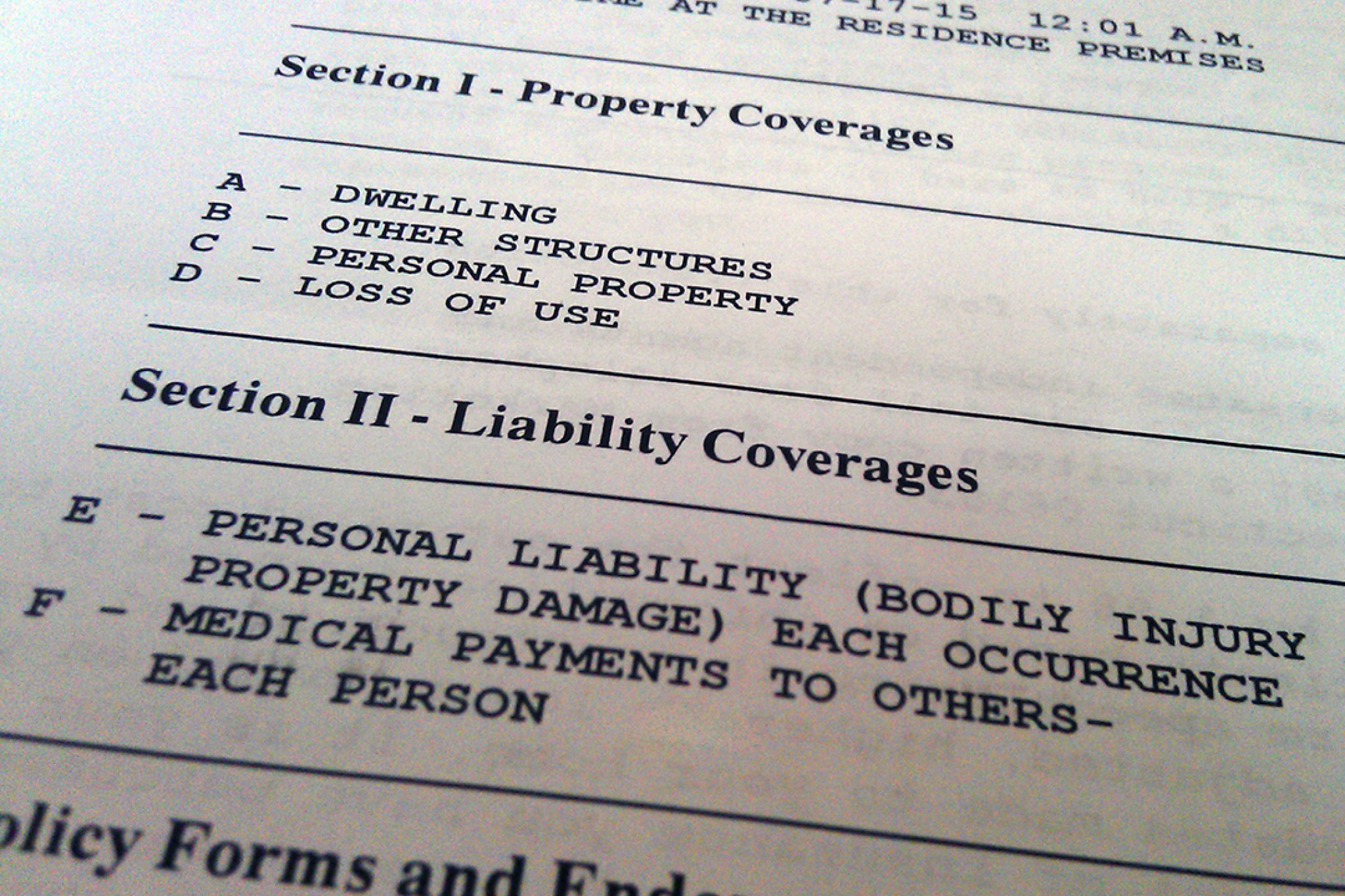

Remember, homeowners insurance is essential. The coverage is designed to protect your home and its contents, as well as shield you from liability for accidents and such on your property.

Block out an hour, call an insurance agent, and get answers to these three important questions.

What Type of Coverage Do I Have?

The most effective type of coverage is known as “replacement cost,” which covers what it would take today to rebuild your house and restore your belongings, up to your policy limits, says Jerry Oshinsky, a partner at Kasowitz Benson Torres in Los Angeles who has represented homeowners in litigation against insurers.

“Extended” replacement cost coverage provides protection to your policy limit, say $500,000, and then perhaps another 20% of the cost after that. Percentages vary, but in this example you could recoup up to $600,000 on a $500,000 policy, assuming your losses reach that high. Extended coverage can compensate for any unanticipated expenses like spikes in construction costs between policy renewals. It's harder to find because of the industry shift toward extended replacement coverage. This “full” or “guaranteed” replacement coverage extends to an entire claim regardless of policy limits.

A less attractive alternative is “actual cash value” coverage that usually takes into account depreciation, the decrease in value due to age and wear. With this type of policy, the $2,000 flat-screen TV you bought two years ago will be worth hundreds of dollars less today in the eyes of your claims adjuster. Kevin Foley, an independent insurance broker in Milltown, N.J., favors replacement cost coverage unless you can save at least 25% on the premium for going with actual cash value coverage instead.

Even if you have replacement cost protection for your dwelling and personal property, don’t assume everything is covered. Structures other than your home on your property — such as a detached garage or swimming pool — require separate coverage. So too do luxury items like jewelry, watches, furs, and artwork if you want full replacement cost. That's because reimbursement for those items is typically capped.

How Much Coverage Do I Really Need?

OK, now that you’re clear on what type of policy you have, you need to figure out how much policy you truly require in dollar terms. Let’s say you purchased your home five years ago and insured it for $200,000. Today, it’s worth $225,000. Simply increasing your coverage to $225,000 may nonetheless leave you underinsured. Here’s why.

The key to determining how much dwelling coverage you need isn’t the value of your home but the money you’d have to pay to rebuild it from scratch, says Carlos Aguirre, an agent for Liberty Mutual Insurance in Irving, Texas. Call your local contractors’ or home builders’ association and ask about the average per-square-foot construction cost in your area. If it’s $150 and your home is 2,000 square feet, you should be insured for $300,000.

There’s no rule of thumb for how much your homeowners insurance should cost. Insurers use numerous factors — age, education level, creditworthiness — to determine pricing, so the same policy could run you more than your neighbor. In recent years the average annual premium was $1,211. Oshinsky advises against scrimping on insurance, because big increases in coverage probably cost less than you’d think. He purchased a liability policy that cost $250 for the first $1 million in coverage. Adding another $1 million increased his premiums by only $12.50.

Related:

How Can I Lower My Premiums?

The higher your deductible, the amount you pay out of pocket before coverage kicks in, the lower your premium. Landing on the appropriate deductible level requires remembering that insurance should cover major calamities, not minor incidents, says Foley. Most homeowners should be able to absorb modest losses like a broken window pane or a hole in the drywall without filing claims. If you can, you’re wasting money with a $250 deductible.

Foley’s rule: If you’re a first-time homeowner and don’t have a lot of savings, moving up to a $500 deductible will probably stretch your budget. However, if you live in a ritzy home and drive an expensive car, you should be able to afford a $1,000 deductible. Most homeowners and renters insurers offer a minimum $500 or $1,000 deductible, according to the Insurance Information Institute. Raising the deductible to more than $1,000 can save on the cost of the policy.

Every major insurer offers discounts to various groups, such as university employees or firefighters. Figure about 5%. Ask which affiliations would entitle you to a discount and how much. If an AARP membership would result in a $50 savings, pay the $16 dues and pocket the $36 difference.

Roof upgrades, sprinklers, a fire alarm, and a burglar alarm each provide savings of over 10% off the national average. Bundling auto and homeowners insurance alone saves an average of $377 on homeowners insurance. For smart home devices, most insurers offer discounts of 5%-20% on your homeowners insurance premium, depending on the device and its ability to reduce your likelihood of filing a claim, according to Bankrate.