The mortgage points deduction may help cut your federal tax bill. With points, sometimes called loan origination points or discount points, you make an upfront payment to get a lower interest rate from the lender when you buy your home.

Since mortgage interest is deductible, your points, as part of your closing costs, may be, too.

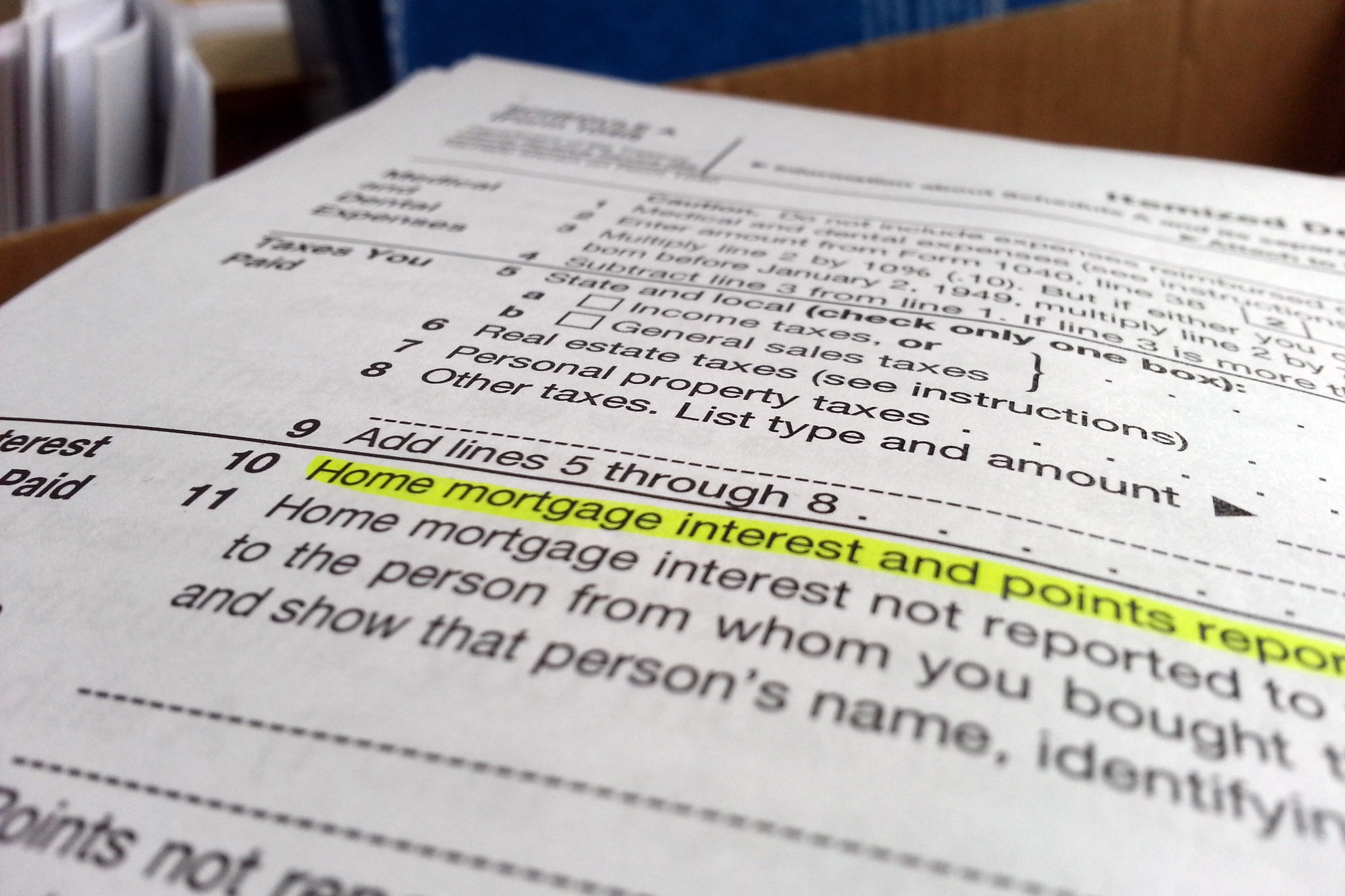

If you take itemized deductions on Schedule A of IRS Form 1040, you may be able to deduct all your points in the year you pay them.

Lucky for you, the IRS doesn’t care whether you or the homeseller paid the points. Either way, those points are your deduction, not the sellers’.

Tip: Tax law treats home purchase mortgage points differently from refinance mortgage points. Refinance loan points get deducted over the life of your loan. So if you paid $1,000 in points for a 10-year refinance, you’re entitled to deduct $100 per year on your Schedule A.

The Fine Print for the Mortgage Points Deduction

The IRS rules for the mortgage points deduction for a home purchase are straightforward, but lengthy. You must meet each of these seven tests to deduct the points in the year you pay them.

1. Your mortgage must be used to buy or build your primary residence, and the loan must be secured by that residence. Your primary home is the one you live in most of the time. As long as it has cooking equipment, a toilet, and you can sleep in it, your main residence can be a house, a trailer, or a boat.

Points paid on a second home have to be deducted over the life of your loan.

2. Paying points must be a customary business practice in your area. And the amount can’t exceed the percentage normally charged. If most people in your area pay one or two points, you can’t pay 10 points and then deduct them.

3. Your points have to be legitimate. You can’t have your lender label other things on your settlement statement, like appraisal fees, inspection fees, title fees, attorney fees, service fees, or property taxes as “points” and deduct them.

4. You must pay the points directly. That is, you can’t have borrowed the funds from your lender to pay them. Any points paid by the seller are treated as being paid directly by you.

In addition, monies you pay, such as a downpayment or earnest money deposit, are considered funds out of your pocket that cover the points so long as they’re equal to or more than points.

Say you put $10,000 down and pay $1,000 in points. The downpayment exceeds the points, so your points are covered and therefore you can deduct them if you itemize. If you were to put nothing down but you paid one point, that $1,000 wouldn’t be deductible under the mortgage points deduction.

5. Your points have to be calculated as a percentage of your mortgage. One point is 1% of your mortgage amount, so one point on a $100,000 mortgage is $1,000.

6. The points have to show up on your settlement disclosure statement as “points.” They might be listed as loan origination points or discount points.

Tip: You can also fully deduct points you pay (for the year paid) on a loan to improve your main home if you meet tests one through five above.

Where to Deduct Points

Figured out that your points are deductible? Here’s how you deduct them:

Your lender will send you a Form 1098. Look in Box 2 to find the points paid for your loan.

If you don’t get a Form 1098, look on the settlement disclosure you received at closing. The points will show up on that form in the sections detailing your costs or the sellers’ costs, depending on who paid the points.

Report your points on Schedule A of IRS Form 1040.

There are Two Things Related to Points You Can’t Deduct:

1. Interest buy-downs your builder paid

Some builders put money in an escrow account (as a buyer incentive) that the lender taps each month to supplement your mortgage payment. Those aren’t considered points even though the money is used for an interest payment and it’s prepaid. You can’t deduct the money the builder put into that escrow account.

2. Interest payments from government programs

You can’t deduct points paid by a federal, state, or local program, such as the federal Hardest Hit Fund, to help you if you’re experiencing financial trouble.

Related: How Long to Keep Tax Records