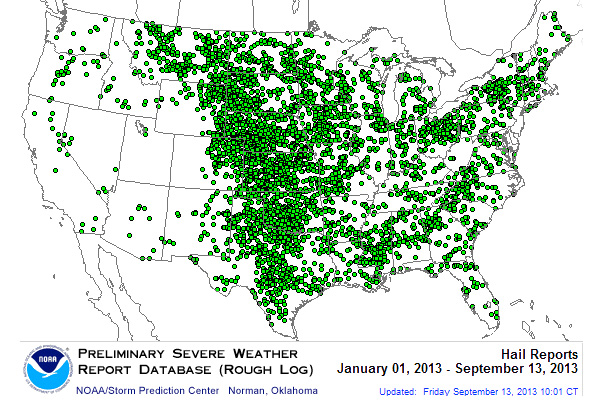

If you live where hail happens most often — basically everywhere in the country east of the line of states running south from Montana — you know it can knock the life out of your roof, making it unlikely to survive into old age the way it would in a place like Rio.

Insurance companies have figured that out, too, and they’re looking to cut their losses by limiting your roof coverage. Hail-related claims increased 84% between 2010 and 2012, according to the National Insurance Crime Bureau.

How to Know if Your Insurer Is Out to Cut Hail Claims

Look for changes like these in your renewal policy:

- Refusing to cover roofs over a certain age (like 10 years).

- Adding a separate hail deductible that’s subtracted from what you’re paid on a hail claim.

- Excluding cosmetic damage like dents in metal roofs, siding, or copper trim.

- Doing roof inspections that note the condition and age of your roof before issuing a policy.

- Not covering roofs made from obsolete shingles. (You can’t buy replacement shingles for patches.)

- Doing partial roof repairs instead of replacing your whole roof (possibly leaving you with a patch that’s a different color than your original roof).

The Biggest, Costliest Insurance Change of All

The big bummer for us consumers: Insurers paying actual cash value rather than replacement value for roof damage.

If you have actual cash value roof coverage, your insurance company will discount your roof claim based on how old your roof is. That can reduce your claims payment by thousands of dollars and leave you with a high-dollar roof replacement bill.

The insurers’ rationale: Your old roof isn’t worth as much as a new roof, so you don’t deserve a new roof when hail damages your old roof.

How Do You Know If Your Policy Pays Actual Cash Value?

- Read the declaration page of your policy.

- Call your insurance agent.

Tip-off that your company is moving you to actual cash value: The company asks how old your roof is or sends an inspector to look at your roof. If you have replacement cost coverage, the age of your roof doesn’t matter. The only reason it would be important to know the age of the roof is if the insurance company plans to pay you for its actual cash value.

If you don’t want actual cost value coverage, you can purchase replacement cost coverage. But you’ll pay more for that.

If your homeowners insurance company adds roof coverage restrictions, shop around for an insurer that won’t limit your hail damage claims.

By the way, hail damage has cost insurance companies so much money that the Insurance Institute for Business and Home Safety (IBHS) created an indoor hail storm to research how different building materials used in roofs, windows, siding, and gutters hold up in storms. The science geeks actually shot man-made hail — a mix of frozen water and seltzer water — from hail cannons at up to 76 mph.

The study found homeowners with metal and wood roofs were twice as likely to file claims; those with slate, wood, and metal roofs have the highest average claim costs (not surprising given the price of those materials).

How to Limit Your Home’s Vulnerability to Hail Damage

If you live in severe hail-prone areas, your roof will likely need to be replaced every seven to 10 years compared with every 20 years for homeowners in less stormy areas, according to insurance industry data.

If you live in a top state for hail storms, consider these IBHS findings when you choose materials to upgrade, replace, or repair your home’s exterior components:

- Look for roofing materials rated by UL 2218 or FM 4473 as Class 3 or 4. All that means is that they’re proven to withstand hail storms.

- Choose materials rated for the wind speed in your area.

- Use an experienced contractor — proper installation ensures the roof will withstand high winds.

Money-saving tip: Ask your insurance agent if you qualify for a homeowners insurance discount for using storm-resistant building materials.

Related: Cut the Costs of Homeownership with These Tips to Make Your Roof Last Longer.

Scams Boost Premiums, Too

It’s not just hail driving up costs; it’s also fraud.

The swindle: Corrupt roofers show up after a hail storm offering to check your roof for damage. Once they’re up there, they damage your roof or worsen what the storm did and then offer to make the repairs.

Scammers also try to pocket more profit by repairing roofs with inferior materials and performing shoddy work.

Protect yourself:

- After storms, don’t respond to offers claiming you can get a “free” roof. (The scammers are assuming your insurance company will pay for it.)

- Only let reliable, experienced, licensed contractors examine your roof.

- Make sure anyone you hire to repair your roof uses the right materials that will hold up to the next hail storm.

Related: Planning a Roof Replacement? Understand the Difference Between Shingles, Shakes, Slate, and More.