After all of the components of the home buying process — negotiations, appraisals, inspections, and insurance — it’s exciting to (finally) get to closing. But do you know what really happens during this final appointment? Closing on a home can be nerve-racking simply because many first-time buyers don't know what to expect or bring along.

Here, we’ll walk through the details of what to expect at closing.

How Your Closing Date Is Set

The closing date is typically set in the offer letter. That's because most sellers will want to know when they can expect the closed sale once the home is under contract. Typically, closing is set 30 to 60 days from when the offer is accepted. This can change, though, depending on various factors, including inspections and paperwork processing with the lender.

How to Select Your Closing Attorney

Depending on the state you live in, closing may take place at the closing attorney’s office or the title company. The buyer has the right to choose the closing attorney, who acts in the interest of the buyer. The closing attorney takes care of the closing “housekeeping” items, such as preparing paperwork, making sure all paperwork is properly signed, conducting a title check on the property, and receiving and distributing money. The closing costs often include the fee for the closing attorney.

If you’re buying a home with an FHA loan, a mortgage loan option backed by the Federal Housing Administration that allows home buyers to put as little as 3.5% down, lenders may recommend one of their pre-approved attorneys. If you, as the buyer, don't have an attorney, the lender can also choose one for you. You’re not required to accept that recommendation.

Closing Paperwork You’ll Receive

Home buying consumers should familiarize themselves with two pieces of paperwork: the loan estimate and the closing disclosure. Both tools explain the loan terms, like interest rate and other costs associated with the loan (for example, taxes and recording fees). You should receive the loan estimate no more than three days after your loan application. Keep the estimate in a safe place to compare with your closing disclosure for any discrepancies.

Your lender must provide you with a closing disclosure, which will resemble your loan estimate, no later than three days before closing. Double-check the interest rate information, address, and all other relevant information for accuracy. If something differs from what you expected, contact your mortgage broker or lender for clarification.

The closing disclosure will detail information about your mortgage loan and the exact amount you’ll need to bring to closing to cover closing costs.

On the day of closing, you’ll receive:

- A mortgage note stating you agree to repay the loan

- A deed of trust to secure the mortgage note

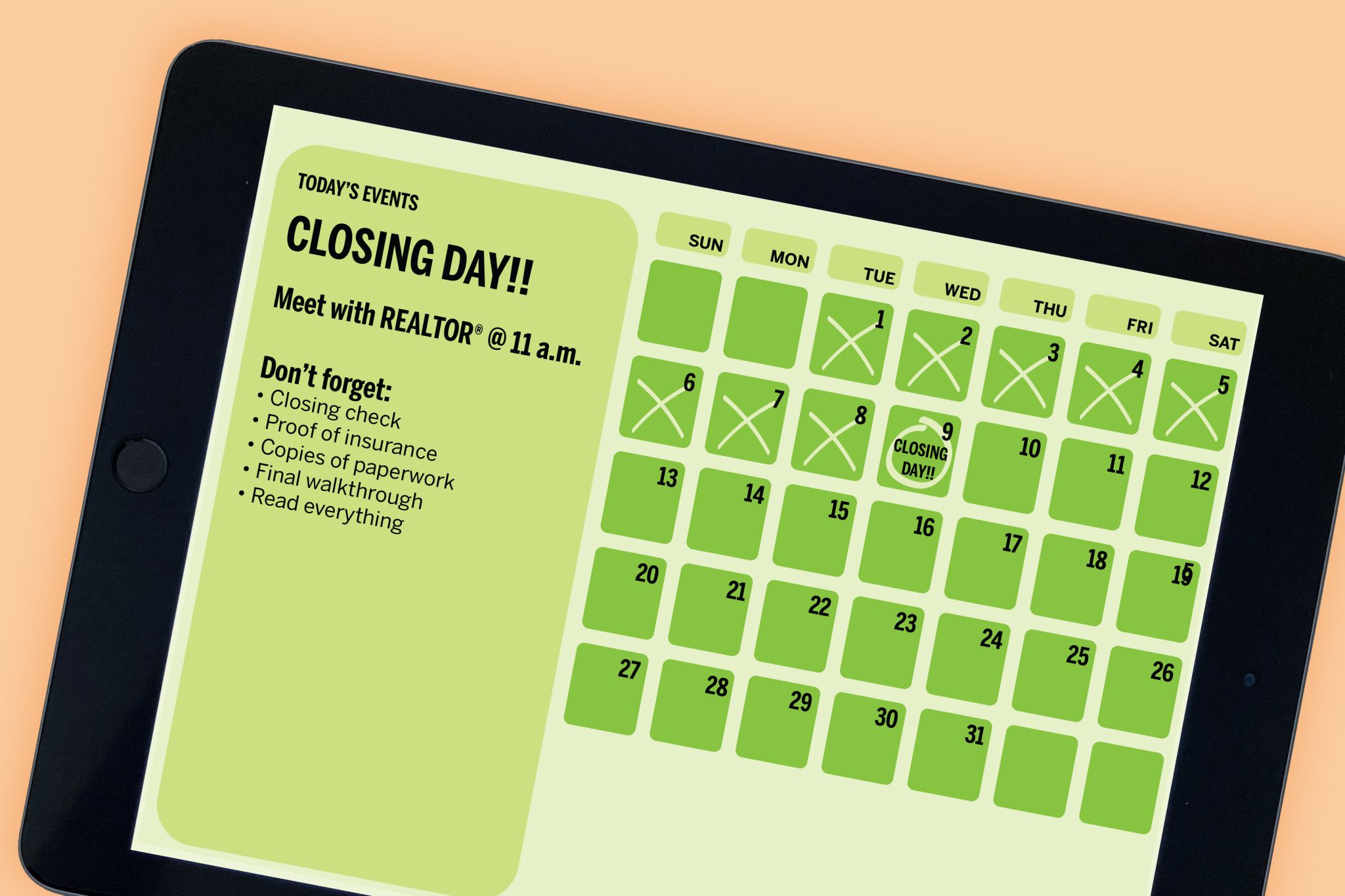

What to Bring to Your Home's Closing

- A cashier's check for closing costs (or paperwork confirming of funds from your bank)

- Proof of homeowners insurance (likely already verified, but bring a copy to closing just in case)

- Copies of any paperwork you’ve received from contract to close (again, just in case, for your reference)

How Long Does Closing on a House Take?

The good news is the actual closing, where you sign paperwork and receive the keys, can take a few hours or less for a simple and straightforward transaction (supposing that you’ve thoroughly reviewed the paperwork beforehand). If the situation is complex, plan for a little more time at closing. Remember, the inspection, appraisal, and other activities before closing on a home can take longer, generally four to six weeks leading up to the closing day.

Common Home Closing Mistakes to Avoid

Given the length of time between contract and closing, most closings should be fairly routine and go smoothly. Why? All of the legwork has been done before this date (such as checking the title, inspecting the home, loan underwriting with the lender, and so on). Unfortunately, hiccups can happen. That's why you'll want to avoid these common mistakes:

- Try to avoid closing on the last day of the month. If something goes wrong, you’ll want time to correct it. This is because prepaid interest on the loan accrues and is due at closing. If pushed to a new month, the interest will continue to build.

- Don't skip the final walk-through. Buyers should do this to ensure no new damage has occurred shortly before closing. If buyers opt not to do this, they cannot hold the seller responsible for damages after property is transferred at closing.

- Don't make any big financial purchases between contract and closing. The bank loaning the money for the mortgage has financed the home based on the most current financial information available. If you finance a car, an appliance, or any other big purchase, this affects your financial information. And that can delay closing on the home significantly. Unless you're facing the most dire circumstances, hold off on big purchases so that you can get into your first home as quickly as possible.

- Don't skim the closing documents. You want to check for typos on names and addresses.

Armed with the information above, first-time buyers should feel comfortable going into their first closing. Once the closing is over, you should receive keys (unless otherwise negotiated with the seller), and you’re officially the owner of your new home!

You May Also Like:

Related: