A signed real estate purchase agreement seems like a done deal, but buyers and their real estate agents still have plenty to do and may need to troubleshoot to keep the deal on track. About 53,000 of home-purchase agreements nationwide were canceled in September 2025, equal to 15% of homes that went under contract that month. That’s up from 13.6% a year earlier, according to a Redfin analysis of MLS pending-sales data.

Buyers are ghosting sellers at a fairly high rate nationwide, mainly because neither party wants to compromise, especially when it comes to concessions and repairs, reports Redfin.

“Just because the contract is signed doesn’t mean the deal is done,” says April Emory, real estate professional with Emorys Rock Realty in Wesley Chapel, Fla. Potential roadblocks include home inspection issues, financing obstacles, mortgage approval challenges, or an appraisal that comes in too low, she adds.

What Is a Real Estate Purchase Agreement?

A real estate purchase agreement, also known as a sales contract, is a written document outlining the terms and conditions of a home sale. It’s the buyer’s contract for the home purchase and is legally binding only when both parties have signed it.

Common Contingencies Included in a Home Purchase Agreement

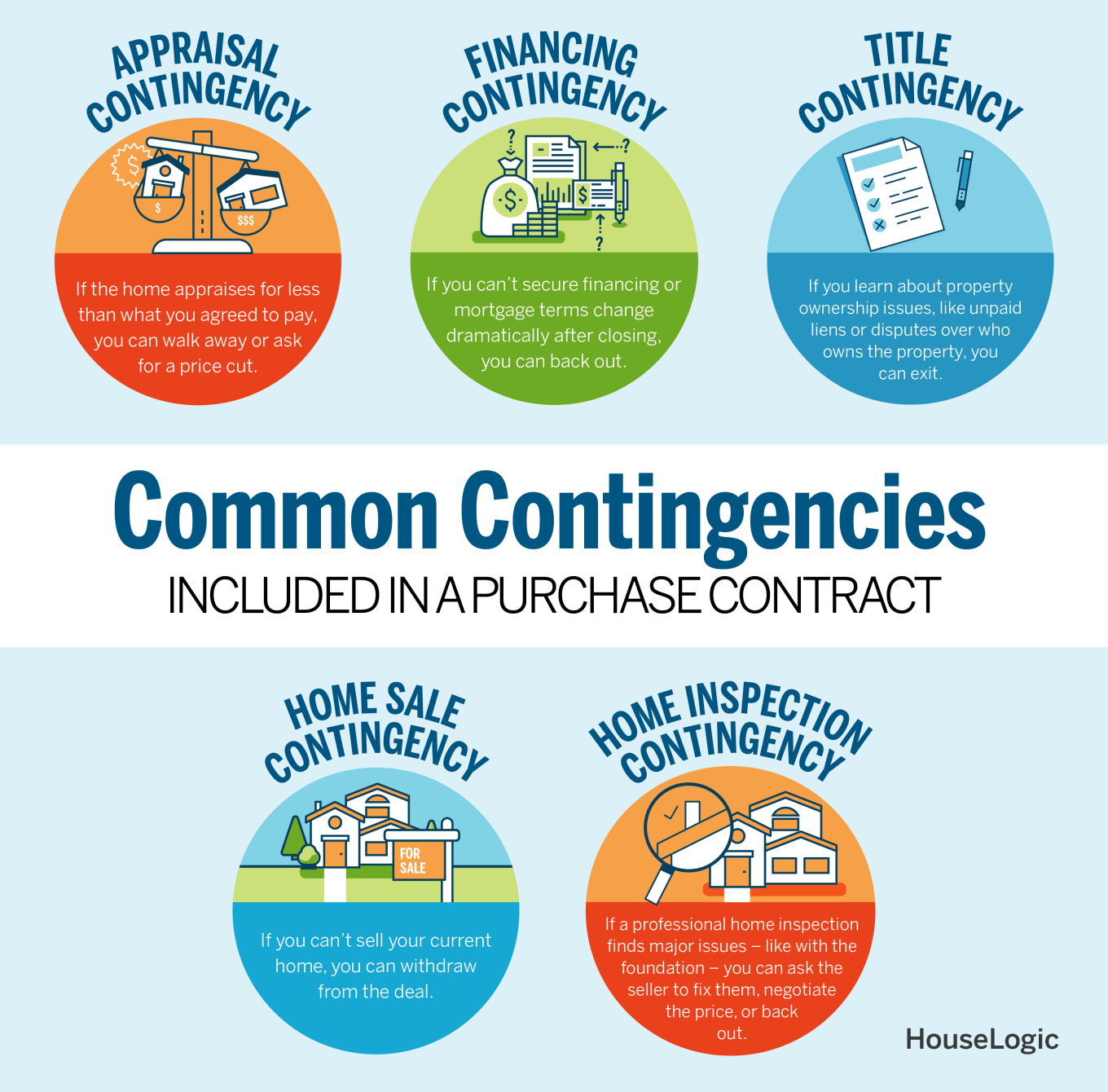

Contingencies are like safety nets for buyers, says Emory. “They allow you to back out of the contract or renegotiate if something significant doesn’t go as expected.” She highlights the most common contingencies included in real estate purchase agreements:

- Home inspection contingency: This allows you to have a home professionally inspected and take action if the inspection report identifies any major issues, like plumbing, electrical, or foundation problems. You may ask the seller to fix them, negotiate the price, or even back out of the deal.

- Appraisal contingency: If the home appraises for less than what you agreed to pay, you can either walk away or ask for a price reduction.

- Financing contingency: You can back out if you can’t secure financing or if the terms change dramatically before closing.

- Home sale contingency: You can back out of the deal if you can’t sell your current home.

- Title contingency: This is intended to lead to a “clear title” — meaning the title company or real estate attorney found no issues with the property’s ownership. Those could include unpaid liens or disputes about who owns the property.

Contracts typically close within 30 to 60 days. In that time, you’ll need to accomplish certain things: resolving contingencies outlined in your purchase contract, meeting contractual deadlines, getting your financing ready, and making sure paperwork is in order.

“[Your agent will] help you navigate the timelines and stay on top of critical deadlines — like when to schedule inspections and meet with the lender, and when your earnest money is due,” Emory says. "If any issues come up, we’ll help you figure out a plan of action and advocate on your behalf.”

8 Tips to Keep Your Real Estate Purchase Agreement on Target

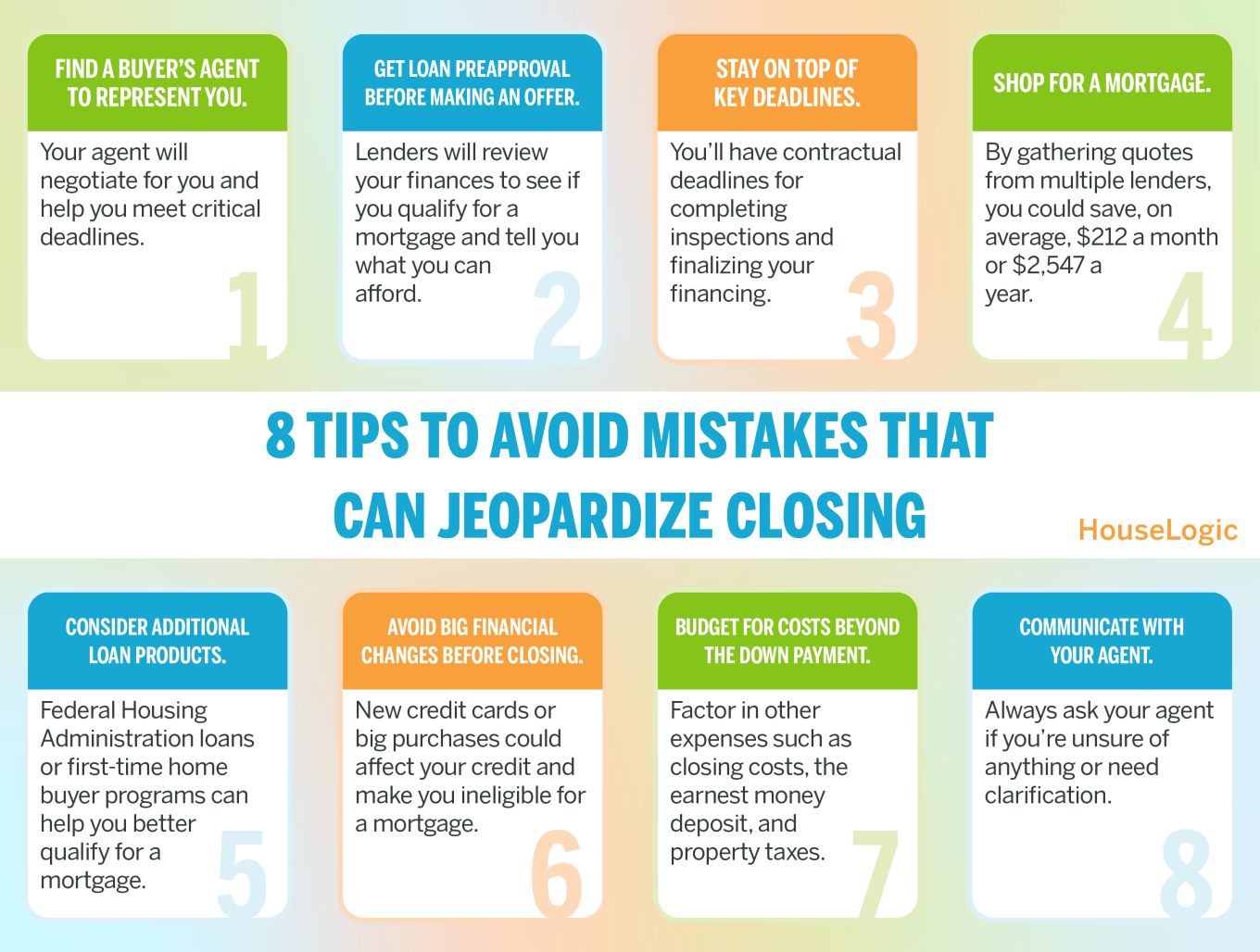

Rookie home buyers may be at risk for missteps that could compromise the purchase. Here are eight tips to to help you stay on the right road:

Tip 1: Find a Real Estate Agent to Represent You

Find one or ask a friend or relative for a recommendation. Your agent will negotiate on your behalf and help you meet critical deadlines in your home purchase.

Tip 2: Get Preapproved Before Making an Offer

Lenders will review your finances to make sure you qualify for a mortgage and tell you what you can afford. Being preapproved helps prevent surprises when finalizing your financing after you’ve found a home.

Tip 3: Stay on Top of Real Estate Purchase Agreement Deadlines

You’ll have contractual deadlines for completing inspections and finalizing your financing. “Even small delays can push back the closing date,” Emory says.

Tip 4: Shop Around for a Mortgage

Gathering quotes from multiple lenders could save you on average $212 a month, or $2,547 a year, according to LendingTree.

Tip 5: Consider All Loan Products

Loan products like Federal Housing Administration loans or first-time home buyer programs may help you qualify for a mortgage and save money.

Tip 6: Steer Clear of of Big Financial Changes

Don’t open up new credit cards or make big purchases before closing. This could affect your credit and even make you ineligible for a mortgage.

Tip 7: Budget for Costs Beyond the Down Payment

Factor in closing costs (typically 2% to 5% of the purchase price), the earnest money deposit, property taxes, and homeowners association fees, if applicable. “Things in homes always break down, so people should put aside a budget for anything that will need fixing,” says Lawrence Yun, chief economist at the National Association of REALTORS®. “A rule of thumb is to anticipate 1% or 2% of the home price for potential maintenance.”

Tip 8: Communicate Clearly With Your Real Estate Agent

Always keep the lines of communication open with your real estate agent, Emory says. “If you’re unsure of anything or need clarification, ask questions. Clear communication can keep everything running smoothly.”

Why Do Sales Fall Through After a Real Estate Purchase Agreement Is Signed?

After a legally binding real estate purchase agreement has been signed, about 7% of real estate transactions were terminated before closing, according to the April 2025 REALTORS® Confidence Index Survey, based on thousands of real estate professionals’ transactions nationwide. Sixteen percent of contracts faced delays to settlement.

Cari McGee, managing broker at RE/MAX Northwest in Kennewick, Wash., says the most common reason she sees are flagged items from a home inspection and the fallout. Either a seller refuses to make fixes or the buyer is too demanding about requests for repairs. In one transaction she worked on, home buyers requested light bulbs in a bathroom to be changed to a softer color, McGee adds.

“I always emphasize to my clients the points in a transaction where the sale could fall apart. But I also assure them that if we face any issues, I can guide them on what we can do,” McGee says.

Here are some common reasons a real estate transaction may not reach closing and options to handle the roadblocks.

Appraisal Is Lower Than Buyer’s Agreement to Pay

The appraised value for the home comes in lower than what the buyer agreed to pay. A lender will approve a mortgage for only the appraised amount.

Options include:

- Negotiate a price reduction with the seller to match the appraised value.

- Agree to pay extra cash to the lender to cover the difference between the appraised value and the purchase price.

- Appeal the appraisal and request a reconsideration. Ask your agent to provide supporting information on comparable sales data to help justify the sales price.

- If you have an appraisal contingency in the home purchase agreement, you can cancel the transaction without penalty.

The Home Inspection Uncovers Serious Problems

No home is perfect, but serious problems —for example, with the home’s foundation or major systems — may concern you enough to renegotiate with the seller.

Options include:

- Ask the seller to make some of the repairs flagged in the inspection report.

- Use the inspection report findings to support a request for the seller to lower the sale price.

- If you have an inspection contingency in the home purchase agreement, you can cancel the transaction without penalty within a certain period of time.

Mortgage Financing Doesn't Come Through

A buyer may be unable to obtain a mortgage to complete the purchase of the home. Sometimes a buyer’s financial situation changes while under contract, such as from a job loss or a sudden medical situation.

Options include:

- Ask the seller to grant a loan extension or extra time to obtain financing.

- Explore alternative financing, such as loans through the Federal Housing Administration, which are known to be more friendly to first-time home buyers. Qualifying requirements for credit scores and down payment thresholds for approval may be more lenient.

- Consider a cosigner or guarantor on the loan, which may help you qualify.

- Ask the seller to consider renegotiating the terms of the real estate purchase agreement to lower the price.

- If you have a financing contingency in the home purchase agreement, you can cancel the transaction without penalty.

Title Inspection Finds Problems

A title inspection of the home could show unresolved liens or legal disputes over the property’s ownership.

Options include:

- Ask the seller to clear the title before closing — for example, by paying off any outstanding lien or resolving any legal disputes involving the property. Wait for the title to be cleared before proceeding.

- Ask the seller to use title insurance to cover the cost of resolving the title issues.

- If you have a title contingency in the home purchase agreement, you can cancel the transaction without penalty.

Buyer Changes Their Mind

Buyers occasionally change their minds about purchasing a home. They may have faced a job relocation, found a house they liked better, been unable to sell their current house, or just fallen out of love with this home.

Options include:

- If the contract includes contingencies — such as for the sale of a current home — find out if those contingencies apply to the situation. Contingencies are used in a real estate purchase agreement to help a buyer cancel a transaction without penalty.

- Back out of the contract and forfeit your earnest money deposit.

Seller Becomes Reluctant

On the flip side, a seller could change their mind. They may have experienced sudden financial trouble, a medical issue, or another situation prompting them to want out of the transaction.

Options include:

- Seek a refund of the earnest money deposit.

- Request compensation because of the seller’s breach of contract. This might include additional costs you might incur as you look for another property.

- Buyers could potentially sue the seller for “specific performance,” to try to force the seller to honor the home purchase agreement, but buyers should weigh the expense and time of waiting for a legal proceeding.

While unavoidable situations can sometimes arise, take heart. After a purchase contract is signed, about 95% of transactions are completed. Working with a real estate agent can help improve your chances that any hiccups won’t derail or delay your transaction.

“Your agent knows your contract backward and forward,” McGee says. “They know when you need to get ‘X’ done and then what you need to do next. They’ll keep buyers on timelines and take them where they need to go.” That is, all the way to a happily ever after in their new home.