-

6 Tips for Maximizing ADU or Rental Property Tax Deductions

In TaxesFind out whether rental property tax deductions are worth your effort.

-

How to Avoid Capital Gains Tax on a Home Sale

In TaxesWhen your home value goes through the roof, you may end up with capital gains when you sell. Here are tips to limit tax liability.

-

Tips for Managing Property Taxes and Finding Tax Rates

In TaxesUnderstand how property taxes affect your budget when you’re shopping for homes.

-

How Long Should You Keep Tax Returns, Records, and Receipts?

In TaxesFor most tax deductions, you need to keep receipts and documents for at least 3 years.

-

5 Good Reasons to Amend Your Tax Return — and How

In TaxesMissed a tax deduction? Overlooked a tax credit? Get what’s coming to you by amending your return.

-

How to Deduct Your Upfront Mortgage Insurance Premiums

In TaxesThe mortgage insurance deduction is back — at least through 2020. But only if you itemize.

-

Did You Make Medically Necessary Home Modifications?

In TaxesYou might be able to claim tax deductions for home improvements made for medical reasons if you itemize and your expenses are sizable.

-

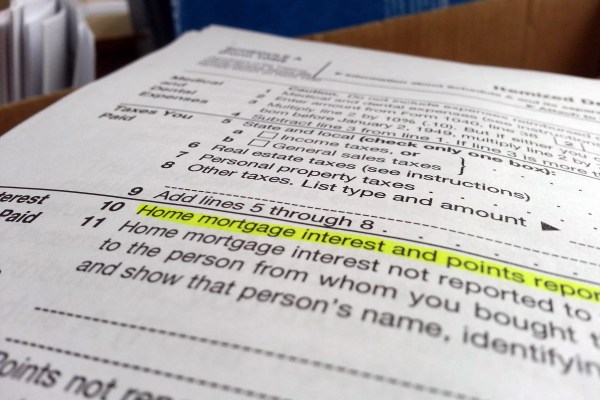

Mortgage Points Deduction: How to Claim It

In TaxesYou may be able to deduct points you paid on a mortgage — but you’ll have to itemize.

-

Rental Property Tax Deductions

In TaxesWhat you can deduct, such as property tax, and what you can’t — but there are definitely more cans than can’ts.

-

Tax Deductions for Vacation Homes

In TaxesTax deductions for a second home vary greatly depending on how much you use the home and whether you rent it out.

Tax Deductions

Home ownership often ratchets up the number of tax deductions you can take. And less taxable income means – wait for it -- you could owe less in taxes. Just one of the benefits of owning a home.

All in Tax Deductions