Your Stress-Free Guide to Shopping for Home Loans

In Buy a Home: Step-by-StepWith this super-simple breakdown of loan types, you’ll find the right mortgage.

Interest rates are only one factor when it comes to buying a house now.

You’ve got options, like repayment help from your employer and coaching from a mortgage broker.

Home buyers who do mortgage loan shopping can avoid leaving money on the table.

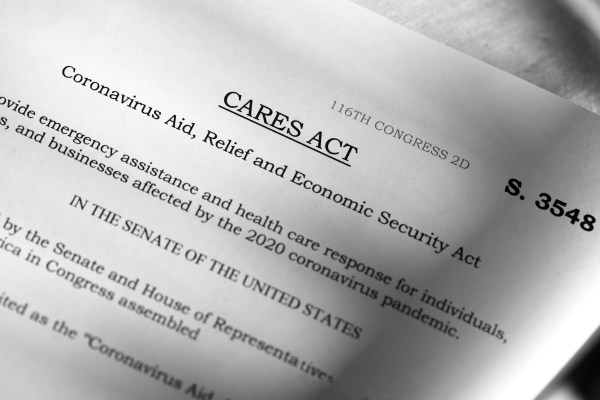

It’s a confusing time, but lenders are putting remedies, like forbearance, in place to help homeowners.

Whether you’re self-employed or applying for an FHA or USDA loan, here’s the pre-approval paperwork you need.

The credit score to buy a house can be as low as 580.

And used a VA loan, which has more restrictions than a conventional one.